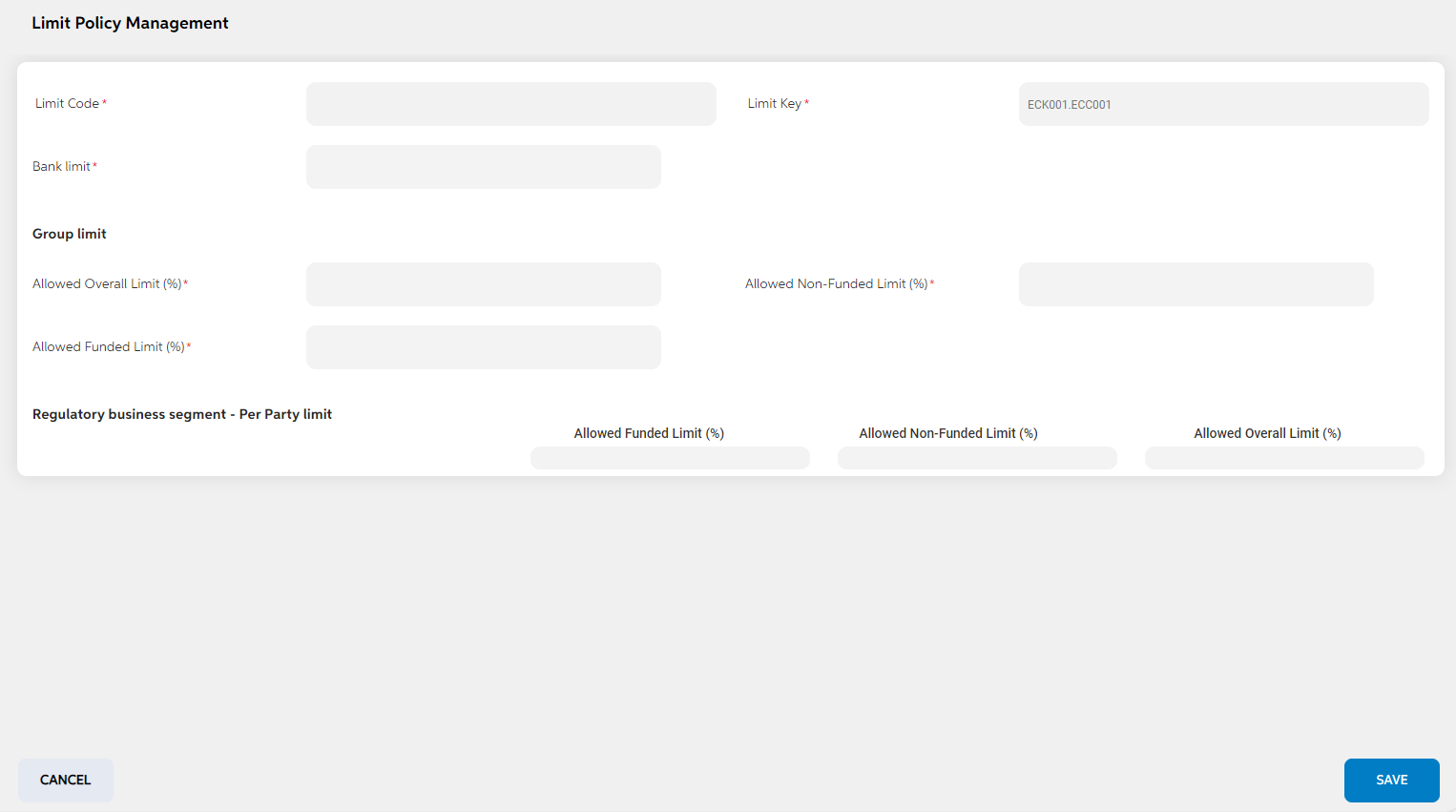

Limit Policy Management

Limit policy management screen is used to configure different limits for the Bank, Customer per party limit and Group per party limit and business segment wise limit. The limit is set to restrict Bank user from lending more than what is allowed for the Bank, restricting bank user from lending its corporate customers more than allowed per party limit set by Bank, similarly restrict bank user from lending its group customer more than allowed group per party limit set by Bank and restrict bank user from lending in each segment more than allowed limit set by Bank. When a deal/facility is created, the deal/facility amount is validated with all above limit mentioned here. This screen is used to allocate limit for each sector, party, group party, segment based on bank’s available equity. This ensures that bank cannot commit more than the available equity.

| Field names | Mandatory/non mandatory | Field type |

|---|---|---|

| Limit code | Mandatory | Auto-populated |

| Limit Key | Mandatory | Auto-populated |

| Bank Limit | Mandatory | Numerical |

| No. of issued shares | Mandatory | Numerical |

| Paid up capital | Mandatory | Numerical |

| Per Value | Mandatory | Numerical |

| Bank's paid up capital | Mandatory | Numerical |

| Group Limit | Mandatory | Numerical |

| Regulatory Business Segment - Per Party Limit | Mandatory | Numerical |

| Screens to Configure (as Pre-requisite) | Screen name | Reflection in user panel | Reflection in admin panel |

|---|---|---|---|

The above screen should be configured first to configure the limit policy management |

limit policy management |

Deals/facility – When a facility or deal is created, System ensure that the limit mentioned here is not exceeded) |

This is reflected only in user panel |

In this topic